Managing your personal finances doesn’t have to be complicated. In fact, one of the most effective budgeting strategies is surprisingly simple — the 50-30-20 Rule. Whether you’re a young professional starting out or someone looking to gain better control of your money, this method offers a practical, easy-to-follow framework to organize your income and expenses.

What is the 50-30-20 Rule?

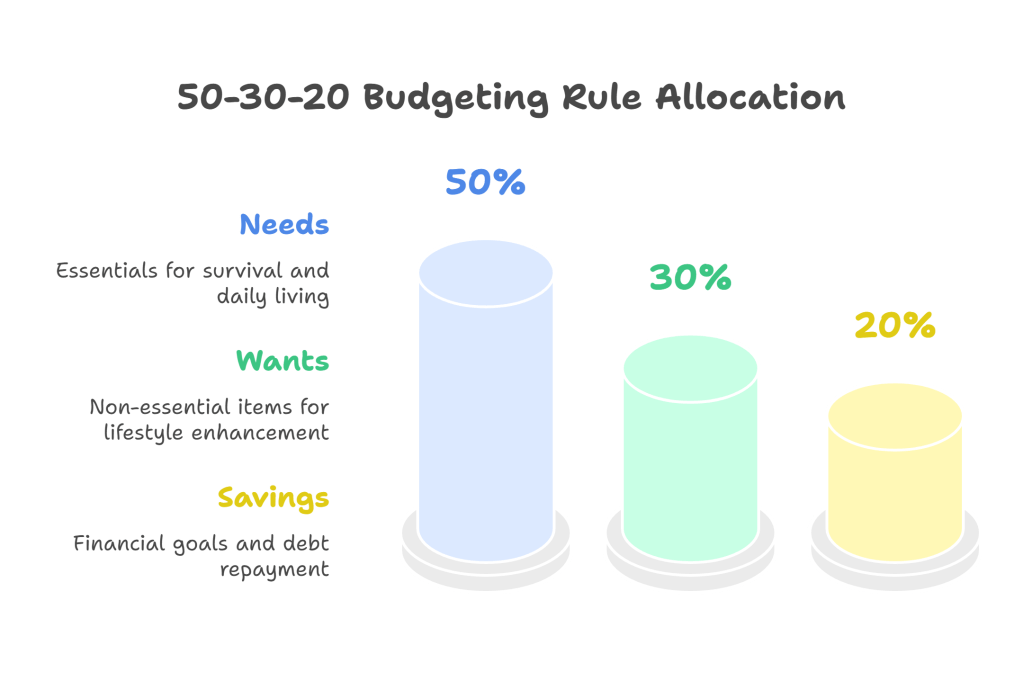

The 50-30-20 Rule is a budgeting guideline that allocates your after-tax income into three clear categories:

- 50% Needs: Essentials you can’t live without.

- 30% Wants: Non-essentials that improve your lifestyle.

- 20% Savings: Financial goals and debt repayment.

This rule, popularized by U.S. Senator Elizabeth Warren in her book “All Your Worth”, is designed to help you make smarter financial choices while allowing room for flexibility and enjoyment.

1. Understanding Each Category

50% – Needs

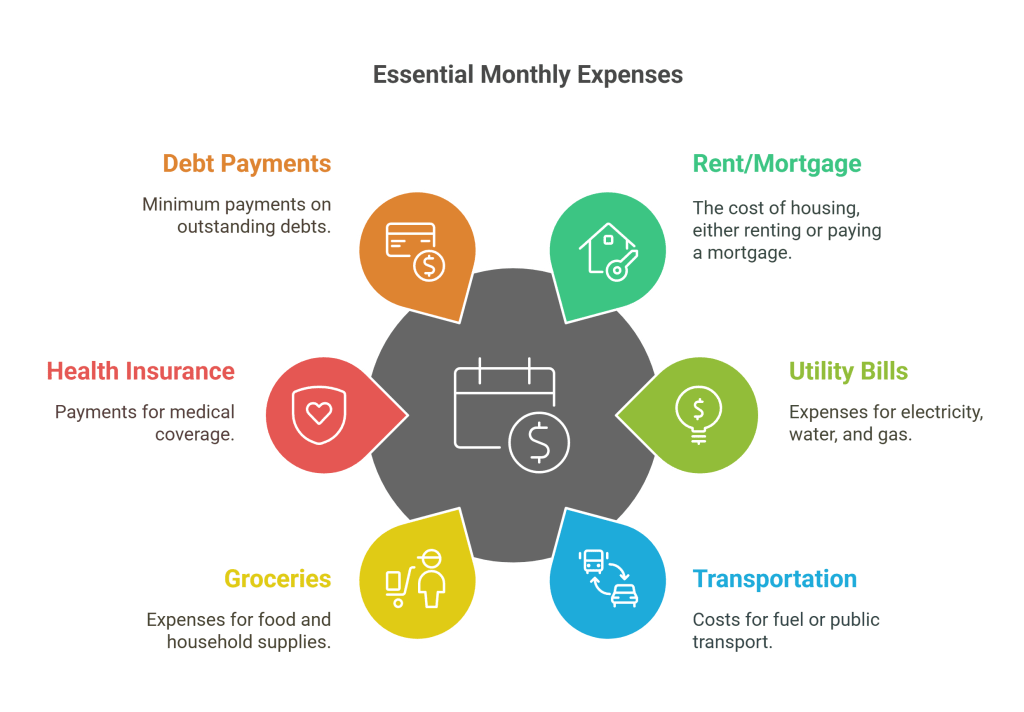

This half of your income goes to expenses that are non-negotiable — things you need to live and work. Examples include:

- Rent or mortgage

- Utility bills

- Transportation (fuel, public transport)

- Groceries

- Health insurance

- Minimum debt payments

Tip: If your needs exceed 50%, look for ways to reduce fixed costs or increase income.

30% – Wants

This is the fun part of your budget. These are the things that improve your quality of life, but are not strictly necessary.

- Dining out

- Shopping

- Travel

- Subscriptions (Netflix, Spotify)

- Hobbies

- Gym memberships

Tip: Be mindful — a want can often disguise itself as a need. Distinguish between the two.

Subscribe to continue reading

Subscribe to get access to the rest of this post and other subscriber-only content.