Introduction – The Retirement Challenge and the Power of Time

Retirement. The word itself conjures up images of relaxation, freedom, and finally having the time to pursue passions unburdened by daily work. It’s a future state that most people aspire to reach comfortably, but for many, the path to get there seems long, complex, and often, intimidatingly expensive. The reality is that securing a comfortable retirement requires foresight, planning, and consistent action over many years. One of the biggest challenges people face is simply starting. Life in our younger years is filled with immediate financial demands – student loans, rent, mortgages, raising families, and perhaps feeling like there’s simply not enough income left over to even think about something as distant as retirement. This often leads to procrastination, with the belief that “I’ll start saving seriously later when I’m earning more.”

While understandable, delaying retirement savings is perhaps the most costly financial mistake one can make. The true secret weapon in the arsenal of retirement planning isn’t timing the market or finding the next hot stock; it’s harnessing the extraordinary power of compound interest, amplified by the one resource younger individuals have in abundance: time. Time is the essential ingredient that allows compound interest to perform its magic, turning even modest, consistent savings into substantial wealth over decades. The difference in accumulated wealth between someone who starts saving early in their career versus someone who waits even just 5 or 10 years can be astonishing, even if the later starter contributes significantly more money annually.

Compound interest, often referred to as “interest on interest,” is the process where the interest earned on your initial investment (the principal) is added back to the principal, and then the next interest calculation is based on the new, larger total. This snowball effect accelerates over time, meaning your money starts working harder for you, earning returns not only on your contributions but also on the accumulated earnings from previous periods. In the early years of saving, the growth might seem slow, but as the principal grows with both contributions and earned interest, the rate of growth accelerates exponentially. This is why time is the critical factor – it provides the runway needed for compounding to truly take off and become the most powerful force in your wealth accumulation journey.

Ignoring or delaying the start of retirement savings means missing out on the most impactful years of this compounding process. The interest earned in the early years, even if small initially, has the longest time horizon to compound and grow exponentially. The dollars saved and the interest earned on those dollars in your twenties or early thirties are significantly more valuable in the long run than dollars saved in your forties or fifties, simply because they have more time to compound.

This blog post will delve into the fascinating world of compound interest and vividly illustrate why starting early is the single most important decision you can make for your retirement future. We will break down how compound interest works, demonstrate its power through compelling examples, provide practical strategies for young people to start saving effectively, address the common obstacles that lead to delay, and ultimately, inspire you to take action now to secure the financial freedom you desire for your retirement years. Your future self will undoubtedly thank you for understanding and acting on the incredible power of starting early with compound interest.

Demystifying Compound Interest: More Than Just Interest on Interest

Compound interest is often called the “eighth wonder of the world” or the most powerful force in the universe by those who understand its potential. Yet, for many, it remains a somewhat abstract concept, less intuitive than simple interest. To fully appreciate why starting early is so crucial, we must first demystify compound interest and understand exactly how it works its magic. It’s more than just earning interest; it’s earning interest on the interest you’ve already earned.

Let’s start with simple interest for comparison. Simple interest is calculated only on the initial principal amount. If you invest $1,000 at a 5% simple annual interest rate, you will earn $50 in interest each year ($1,000 * 0.05). After 10 years, you would have your initial $1,000 plus $500 in interest, for a total of $1,500. The interest earned each year remains constant because it’s always calculated on the original principal.

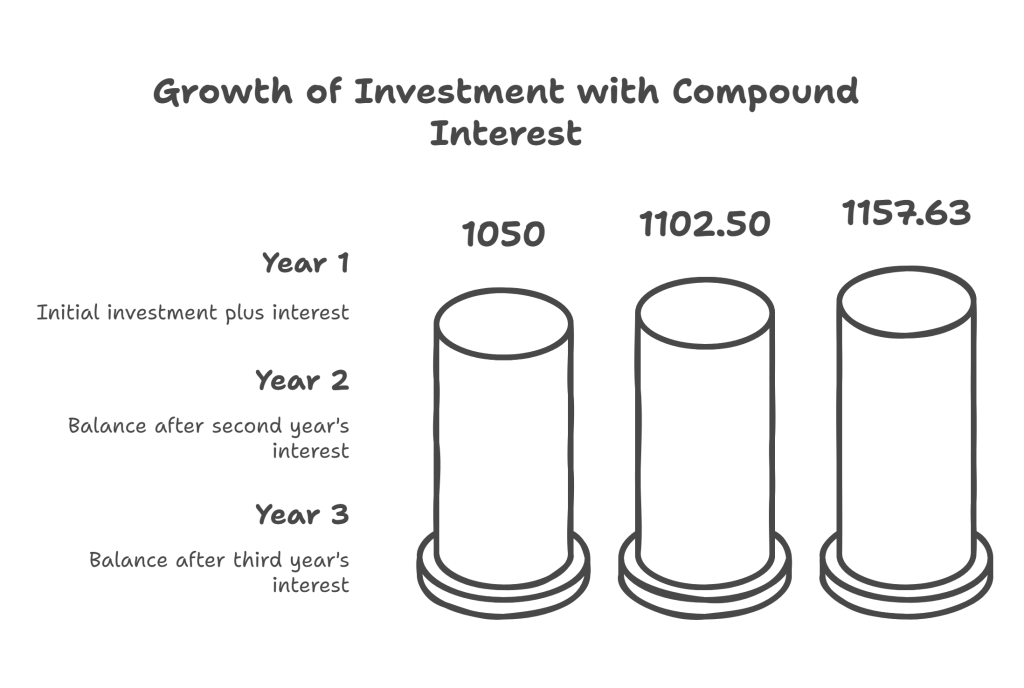

Compound interest, on the other hand, works differently. With compound interest, the interest earned in each period is added to the principal, and the interest for the next period is calculated on this new, larger principal. Using the same example: if you invest $1,000 at a 5% compound annual interest rate:

- Year 1: You earn $50 in interest ($1,000 * 0.05). Your new balance is $1,050.

- Year 2: You earn interest on the new balance of $1,050. Interest earned is $52.50 ($1,050 * 0.05). Your new balance is $1,102.50.

- Year 3: You earn interest on $1,102.50. Interest earned is $55.13 ($1,102.50 * 0.05). Your new balance is $1,157.63.

Notice how the amount of interest earned increases each year ($50, $52.50, $55.13…). This is because the principal amount is growing with the addition of the earned interest. This might seem like a small difference in the early years, but over long periods, the gap between simple and compound interest growth becomes enormous.

Think of it like a snowball rolling down a hill. As it rolls, it picks up more snow, getting bigger. The bigger the snowball gets, the more snow it picks up on each rotation, causing it to grow at an accelerating pace. Your initial investment is the small snowball. The interest earned is the snow it picks up. Compound interest ensures that the “snow” (interest) you pick up in one period becomes part of the snowball (principal) for the next rotation, allowing it to pick up even more snow.

The frequency of compounding also matters. While our example used annual compounding, interest can compound more frequently (quarterly, monthly, daily). The more frequently interest is compounded, the faster your money grows, as interest is added to the principal and starts earning its own interest sooner. Retirement accounts typically compound interest, often with reinvested dividends and capital gains further accelerating growth.

Understanding this accelerating growth is key to understanding the power of starting early. The early years of compounding are when your interest starts earning its own interest and when those initial, seemingly small contributions lay the foundation for significant future growth. The longer your money is invested, the more cycles of compounding it goes through, and the more pronounced the snowball effect becomes. This fundamental principle is the engine that drives long-term wealth accumulation, making starting early not just beneficial, but truly transformative for your retirement savings journey.

The Magic of Starting Early: Witnessing Compound Growth in Action

Subscribe to continue reading

Subscribe to get access to the rest of this post and other subscriber-only content.